As per a letter published by the Office of the Comptroller of the Currency of the United States (OCC), national banks and federal savings associations may participate in independent node verification networks (INVN) and use stablecoins to perform bank-permissible functions.

The OCC describes INVNs as shared electronic databases (such as a distributed ledger) where copies of the same information (such as transactions) are stored on multiple computers. Participants in an INVN are known as nodes and typically participate in the network’s pre-determined process to validate transactions, store transaction history, and broadcast transaction data to other nodes.

A stablecoin is a type of cryptocurrency that is designed to have a stable value. Some stablecoins are backed by fiat currency, and these can typically be exchanged for the underlying fiat currency on a one-for-one basis. In this regard, the stablecoin represents a mechanism for storing, transmitting, and exchanging the underlying fiat currency value.

Customers have continuously sought for cheaper, faster, and more efficient means of effecting payment transactions. And while their role as financial intermediaries has remained unchanged, banks have indeed adopted new technologies over time to meet the evolving financial needs of the global economy, facilitate cross-border payments, and support global financial transactions. INVNs and stablecoins represent a new means for transmitting payment instructions and validating payment transfers.

In the sections below, we review the “very old business of banking”, how INVNs and stablecoins represent an alternative mechanism to facilitate payment transactions, and how this may affect banks located in offshore jurisdictions such as the Cayman Islands.

Old Business of Banking

Stablecoins as Electronic Stored Value

Banks may offer a variety of electronic stored value (ESV) systems to its customers to facilitate payment transactions as the “creation, sale, and redemption of ESV in exchange for [fiat currency] is part of the business of banking.” In any ESV system, cash is exchanged for the ESV. Banks have historically used a variety of instruments to represent fiat currency, such as cashiers’ checks, travelers’ checks, drafts, debit cards, credit cards and electronic funds transfers, and used them as a mechanism of payment to settle transactions.

In this regard, stablecoins serve as another form of ESV and electronic representation of fiat currency as “this distinction is technological in nature and does not affect the permissibility of the underlying activity.”

INVNs as Payment Transfer Systems

A Global Accessible Payment Infrastructure

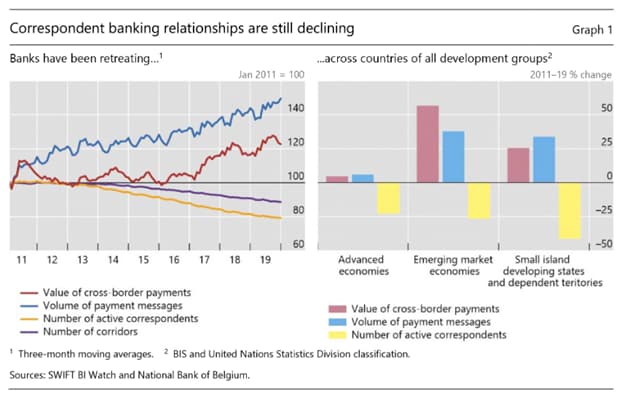

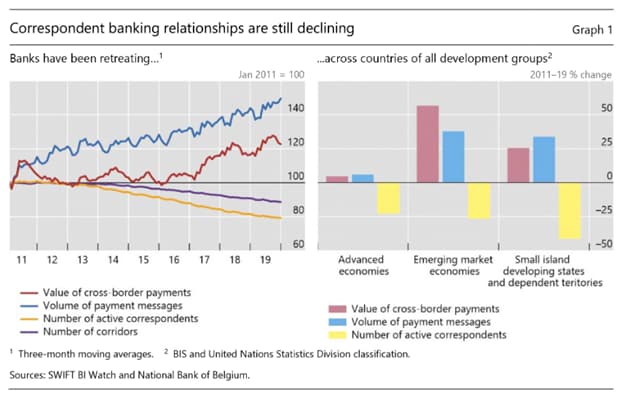

Correspondent banking relationships enable banks to access financial services in different jurisdictions across the world and support cross-border payments, which are pivotal for economic activity, international trade, and global development. While the volume and value of cross-border payments continue to rise, the number of active correspondent banks and cross-border relationships continue to shrink.

Old Business of Banking

As per the OCC, “the primary role of banks is to act as recognised financial intermediaries” between other non-bank participants. In this role, banks provide the expertise to facilitate the exchange of payments and settle transactions between parties. This includes electronic payments message transmission, electronic payments processing, and payments settlement among members.

These bank-permissible activities may be conducted using electronic means or facilities consistent with safe and sound banking practices. Over time, banks have continually adopted new and evolving technology systems such as the development and operation of electronic funds transfer systems and real-time settlement systems.

In this regard, INVNs represent a new means to conduct the very old business of banking, facilitate payments transactions, and perform bank-permissible functions.

Stablecoins as Electronic Stored Value

Banks may offer a variety of electronic stored value (ESV) systems to its customers to facilitate payment transactions as the “creation, sale, and redemption of ESV in exchange for [fiat currency] is part of the business of banking.” In any ESV system, cash is exchanged for the ESV. Banks have historically used a variety of instruments to represent fiat currency, such as cashiers’ checks, travelers’ checks, drafts, debit cards, credit cards and electronic funds transfers, and used them as a mechanism of payment to settle transactions.

INVNs as Payment Transfer Systems

At its core, payment activities involve (1) transmitting instructions to transfer a certain sum from one account to another account (either at the same bank or at a different bank), and (2) validating that these payments are made.

An established, globally accepted mechanism to transmit instructions is the communication system or message standard developed by the Society for Worldwide Interbank Financial Telecommunications (SWIFT). An “MT103” is a common standard SWIFT payment message template used between banks to instruct payment transactions internationally.

A clearing system is then used to carry out the transfer of funds, such as the Fedwire Funds Service and Clearing House Interbank Payments System (CHIPS) in the United States, and a centralized entity generally validates that these payments have been made, such as the Federal Reserve and New York Clearing House Association, respectively.

Serving as a node on an INVN represents a new means of transmitting payment instructions, and the subsequent transfer is carried out and validated by a comparatively large number of independent nodes on the shared network.

A Global Accessible Payment Infrastructure

Correspondent banking relationships enable banks to access financial services in different jurisdictions across the world and support cross-border payments, which are pivotal for economic activity, international trade, and global development. While the volume and value of cross-border payments continue to rise, the number of active correspondent banks and cross-border relationships continue to shrink.

If the OCC approval is the start of recognising stablecoins as ESV and INVNs as payment rails, banks in the Cayman Islands may be afforded the opportunity to access a new, open, global payment infrastructure system. These networks are active and accessible today.

An example of a stablecoin is the USD Coin (USDC). USDC is redeemable on a one-for-one basis for US dollars, are backed fully by US dollar reserves, and is issued by regulated financial institutions. USDC is available on several INVNs, such as the Algorand network (Algorand). An attestation is made monthly by Grant Thorton LLP to the amount of US dollar held in reserves. As of 31 December 2020, there were 4 billion USDC in circulation.

In addition to developing correspondent banking relationships globally, a bank can cultivate a deep grasp and know-how of Algorand directly and serve as a node on its network. By participating on Algorand, the bank would be agreeing to its process for validating how transactions are processed and confirmed. This process is open source and publicly available at any time.

In order to set up as a node on Algorand, a bank would have to learn how to set-up an institutional resilient technical environment, understand its core features and valid message formats, implement an enterprise grade private key infrastructure system, and have appropriate internal policies and procedures in place.

When a payment instruction is received from a customer, a bank has several options on how to effect the payment. The bank may choose to prepare a (i) MT103 message (ii) in the SWIFT system (iii) to transfer US dollars.

Alternatively, the bank may choose to prepare a (i) valid formatted and signed message (ii) in accordance with parameters and criteria of Algorand (iii) to transfer USDC. Once the message is ready, the bank would broadcast the message containing the payment instruction to the other independent nodes on Algorand, and the transfer of USDC would be completed once it is validated by these participants.

The OCC and the United States have recognised INVNs as new payment infrastructure systems and stablecoins as a new means to represent ESV. As more jurisdictions contemplate to do the same, Cayman-based banks have the opportunity to act as an independent, equal participant in an open payment system that can access financial services from jurisdictions across the globe.